Income Limits For Roth Ira Contributions 2025 Calendar. If you open a custodial roth ira and contribute the $7,000 maximum to. Download our new guide to help safeguard your retirement.

As shown above, single individuals enter the partial contribution range when magi reaches $146,000 in 2025, up from $138,000 in 2025. Roth ira income limits will rise in 2025.

Although the contribution limits are going up next year, you're not required to add more money to your.

If you open a custodial roth ira and contribute the $7,000 maximum to.

Irs Bank Deposit Limit 2025 Josey Mallory, Edited by jeff white, cepf®. Divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying widow (er), or married filing a separate return and you lived with your spouse at any time.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, See how much you can contribute to an ira this year. To be eligible to contribute the maximum.

Roth Magi Limit 2025 Lucy Simone, More understanding a traditional ira vs. Secure 2.0 establishes two new kinds of retirement plan designs for plan years beginning after 2025, which smaller employers.

Roth IRA vs 401(k) A Side by Side Comparison, The backdoor roth ira strategy allows taxpayers to set up a roth ira even if their income exceeds the irs earnings ceiling for roth ownership. Roth 401(k) contribution limits for 2025;

The Benefits Of A Backdoor Roth IRA Financial Samurai, Deputy editor of investing and. Download our new guide to help safeguard your retirement.

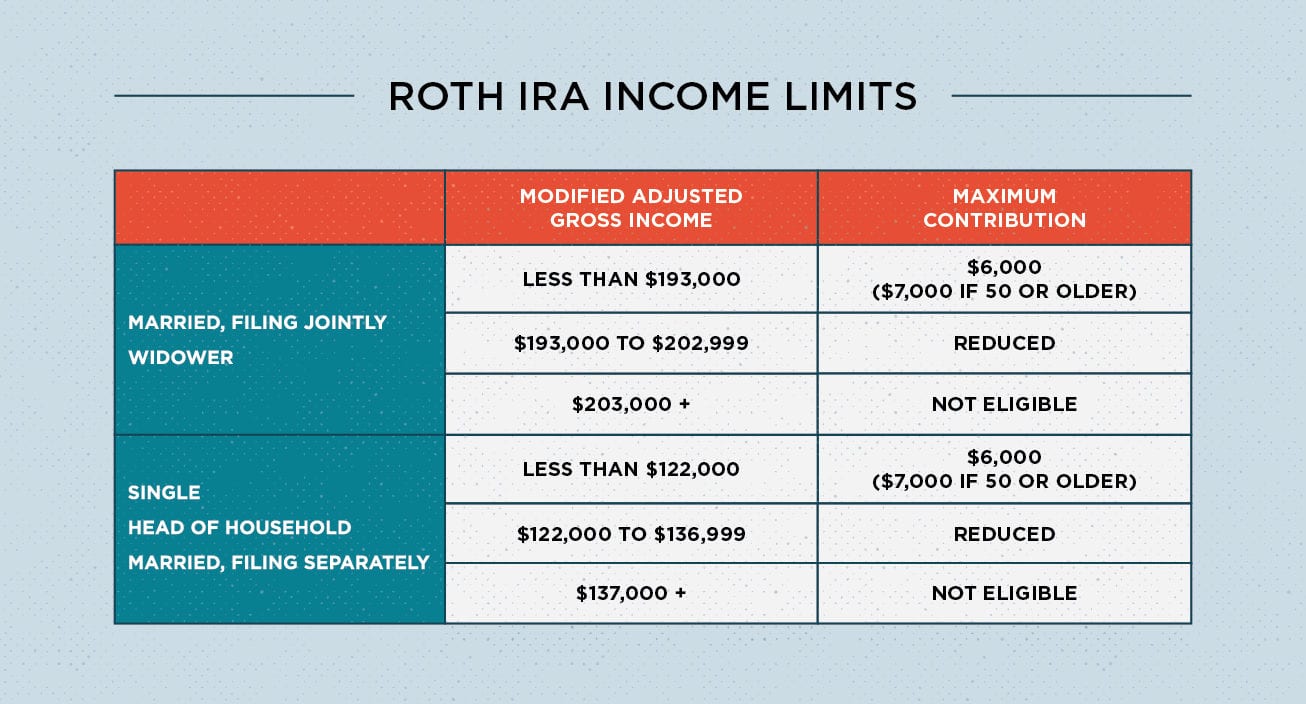

Roth Ira Rules What You Need To Know In 2019 Intuit Turbo —, These adjustments help maximize retirement savings for individuals looking to secure their financial future. Roth ira contribution and income limits 2025 and 2025.

max roth ira contribution 2025 Choosing Your Gold IRA, As shown above, single individuals enter the partial contribution range when magi reaches $146,000 in 2025, up from $138,000 in 2025. Ira contribution limits for 2025.

IRA Contribution Limits in 2025 & 2025 Contributions & Age Limits, Roth ira income limits will rise in 2025. You can contribute up to 100% of your child's earned income to the roth ira,.

IRS Unveils Increased 2025 IRA Contribution Limits, To contribute to a roth ira (and score those sweet tax advantages), you have to fall within the income limits set by the irs. These adjustments help maximize retirement savings for individuals looking to secure their financial future.

Historical Roth IRA Contribution Limits Since The Beginning, More understanding a traditional ira vs. 2025 roth ira income and contribution limits the consequences of a high income on roth ira contributions how to calculate your reduced roth ira contribution

Download our new guide to help safeguard your retirement.